Open Enrollment

October 1 – 31, 2025 extended to November 7, 2025

Your benefit choices affect your health and your family’s wellbeing for the entire year. This year, Open Enrollment is more important than ever due to major plan changes.

Log in to your Benefits Central Portal — available 24/7

Or call the LAwell Benefits Service Center: 833-4LA-WELL (833-452-9355)

Monday – Friday, 8:00 a.m. to 5:00 p.m.

Extended Hours: October 30–31 November 6-7, 8:00 a.m. to 7:00 p.m.

What's New for 2026:

New medical insurance carriers coming in 2026

Open Enrollment runs from October 1–31, EXTENDED to November 7, 2025. Beginning January 2026, the LAwell Program will welcome two new medical insurance providers:

- Blue Shield and UnitedHealthcare will replace Anthem.

- Kaiser Permanente will remain available.

Review your options and be ready to take action.

Dependent Eligibility Verification Audit

The LAwell Program will conduct a comprehensive audit of all dependents enrolled in City-sponsored benefits in early 2026. Open Enrollment is your final opportunity to remove any ineligible dependents without penalty.

- No penalties apply if removed during Open Enrollment.

- Ineligible dependents identified later will require repayment of premiums paid by the City during the period of ineligibility.

For eligibility and next steps, see the Dependent Eligibility Verification Audit FAQ.

New High Deductible Health Plan (HDHP)

The LAwell Program introduces the Blue Shield HDHP PPO, which offers lower premiums and access to a Health Savings Account (HSA).

- Lower monthly premiums

- Pre-tax savings for qualified medical expenses

- HSA funds roll over each year and are yours to keep

Because this plan has a higher deductible, it may not be right for everyone—especially those who anticipate high medical expenses. It can be a good option for individuals who expect to use fewer services and want to build long-term HSA savings.

2025 → 2026 Medical Plans

| 2025 Medical Plans | 2026 Medical Plans |

|---|---|

| Anthem Full HMO (CA Care) | UHC Signature Value (SV) HMO |

| Anthem Narrow HMO (Select) | UHC SV Harmony HMO |

| Anthem Vivity HMO | Blue Shield Trio HMO |

| Anthem PPO | Blue Shield PPO |

| — | Blue Shield HDHP PPO |

| Kaiser | Kaiser |

This table shows the medical plan changes for 2026 compared to 2025.

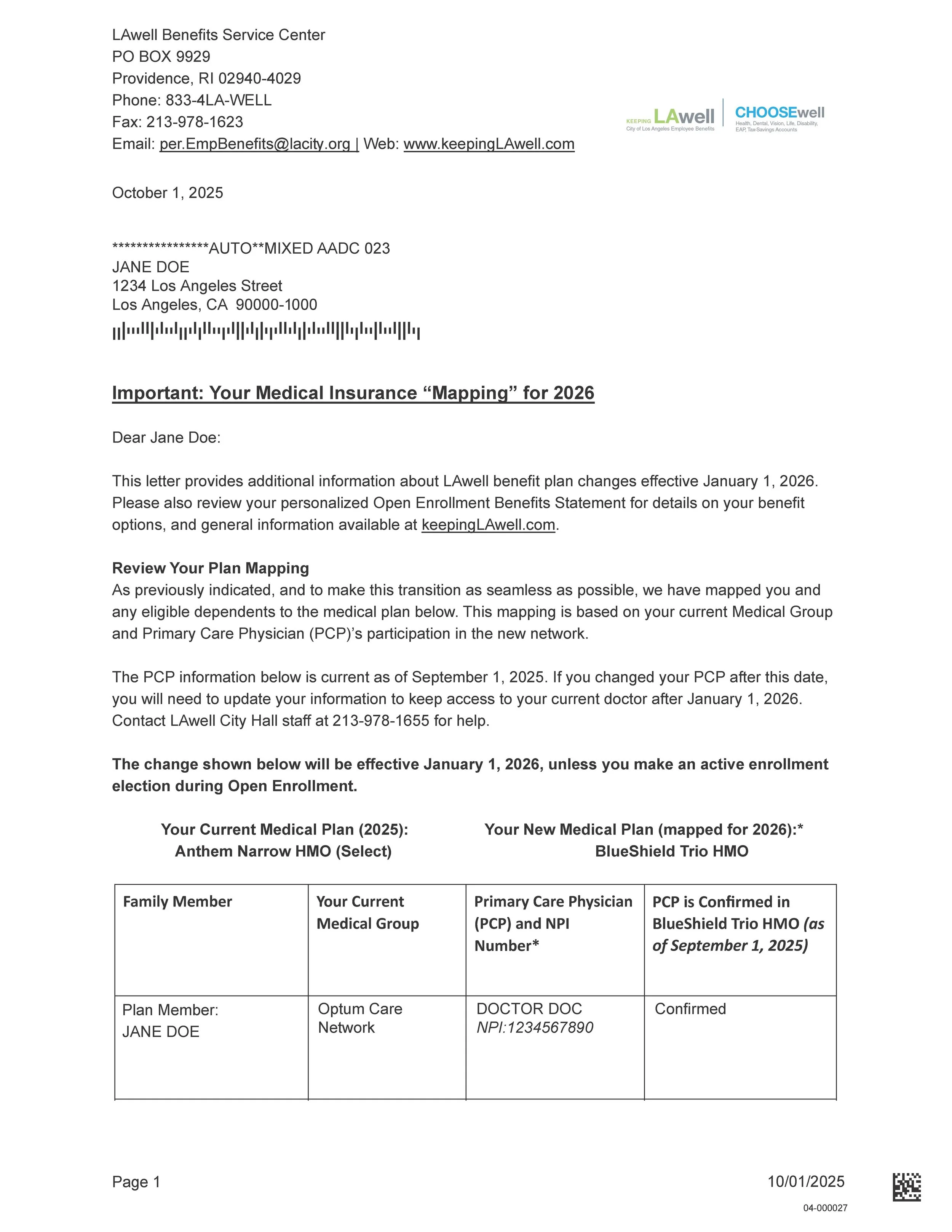

Your Anthem Change and PCP Mapping Explained

What’s changing, how your plan will be mapped, and what (if anything) you need to do.

Anthem will no longer be available through the LAwell Program starting January 1, 2026. If you’re currently enrolled in an Anthem plan and take no action during Open Enrollment:

- HMO members: You’ll be automatically mapped to a Blue Shield or UnitedHealthcare HMO that includes your current Primary Care Physician (PCP), if possible.

- PPO members: You’ll be reassigned to the Blue Shield PPO plan, which uses the same network but offers lower premiums.

Every LAwell member will receive a medical plan mapping letter. The same letter will be mailed to the address on record and available online through the Benefits Central Portal. Anthem HMO members should pay special attention: the letter includes your PCP information and confirms how your PCP is mapped. Some letters will indicate Action Required.

Decision & Actions by Scenario

| Medical Mapping Letter PCP status | Your “Mapped” Medical Plan |

Action |

|---|---|---|

| All PCPs Confirmed | Keep ‘mapped’ Medical Plan as shown | No Action needed – LAwell will transmit your confirmed PCPs to your new plan. |

| All PCPs Confirmed | Change ‘mapped’ Medical Plan | Action needed – When you elect your new plan, you will need to provide your PCP information. |

| One or more PCPs unknown or Not Confirmed | Keep or Change Medical Plan | Action needed – You may be auto-assigned a PCP if details are missing. Provide your doctor’s information as soon as possible. |

| N/A – PPO | Change to Blue Shield/UHC HMO | Action needed – PCP required. |

| N/A – Kaiser | Change to Blue Shield/UHC HMO | Action needed – PCP required. |

| N/A – Kaiser | Keep Kaiser Or Change to PPO or HDHP PPO |

No Action needed – PCP not required. |

| N/A – PPO | Keep PPO Or Change to HDHP PPO or Kaiser |

No Action needed – PCP not required. |

Plan Highlights & Enrollment 2026

Plan Types (Quick Guide)

- HMO: Care managed by a Primary Care Physician (PCP) who coordinates referrals.

- PPO: See any doctor without a referral; strongest coverage in-network.

- HDHP PPO: Higher deductible; still a PPO (no referrals). May be HSA-eligible.

Personalized Benefit Statement

What it is

Your personalized statement shows your current benefits, your 2026 options specific to your situation, and what your elections will be if you don’t take action.

Where to find it

Log into your Benefits Central Portal and click the “Open Enrollment 2026” tile in the middle of the home page. From this tile, you can access your personalized communications and start your enrollment.

- Go to KeepingLAwell.com and open the Benefits Central Portal.

- Click the Open Enrollment 2026 tile to download your statement.

Tip: After you review your statement, return to the tile to start or update your enrollment.

Kaiser HMO (No Changes)

Kaiser benefits remain the same in 2026. No PCP selection required; services are within Kaiser facilities and pharmacies.

Common Medical Group Availability

Snapshot for convenience only—always confirm your specific PCP in each plan directory at KeepingLAwell.com/ProviderLookup.

| Medical Group | Blue Shield Trio | UHC Harmony | UHC SV |

|---|---|---|---|

| Allied Pacific IPA | ✅ | ✅ | |

| AXMINSTER | ✅ | ✅ | |

| Cedars-Sinai | ✅ | ||

| Facey Medical Foundation | ✅ | ||

| Lakeside | ✅ | ||

| MemorialCare | ✅ | ✅ | |

| Optum | ✅ | ✅ | ✅ |

| PIH Health | ✅ | ✅ | |

| Providence | ✅ | ✅ | ✅ |

| Regal Medical Group | ✅ | ||

| Torrance Memorial | ✅ | ✅ | ✅ |

| UCLA Medical | ✅ |

HMO Plan Highlights: In-Network Only

| Type of Care | Blue Shield Trio HMO | Kaiser Permanente HMO | UnitedHealthcare SignatureValue (SV) HMO |

|---|---|---|---|

| Calendar Year Deductible | $0/person; $0/family | $0/person; $0/family | $0/person; $0/family |

| Calendar Year Out-of-Pocket Limit | $500/person; $1,500/family | $1,500/person; $3,000/family | $500/person; $1,500/family |

| Routine Office Visits | Plan pays 100% after $15 Copay | Plan pays 100% after $15 Copay | Plan pays 100% after $15 Copay |

| Preventive Care | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) |

| Urgent Care | Plan pays 100% after $15 Copay | Plan pays 100% after $15 Copay | Plan pays 100% after $15 Copay |

| Telehealth/Virtual Visits | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) |

| Maternity Care (Preventive Care Visit) | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) |

| Pregnancy | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) |

| Inpatient Hospitalization | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) |

| Outpatient Surgery | Plan pays 100% ($0 Copay) | Plan pays 100% after $15 Copay | Plan pays 100% ($0 Copay) |

| Diagnostics & Advanced Imaging | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) |

| Emergency Room Care | Plan pays 100% after $100 Copay | Plan pays 100% after $100 Copay | Plan pays 100% after $100 Copay |

| Emergency Medical Transportation | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) | Plan pays 100% ($0 Copay) |

| Hearing Aid Benefit | Plan pays 100%; hearing aids per 24 months | $2,000 allowance each ear every 36 months | Plan pays 100% pair each 24 months; $5,000 annual max |

PPO Plan Highlights: In-Network & Out-of-Network

| Type of Care | Blue Shield PPO In-Network |

Blue Shield PPO Out-of-Network |

Blue Shield HDHP PPO In-Network |

Blue Shield HDHP PPO Out-of-Network |

|---|---|---|---|---|

| Calendar Year Deductible | $750/person; $1,500/family | $1,250/person; $2,500/family | $2,200/person; $4,400/family | $4,000/person; $8,000/family |

| Calendar Year Out-of-Pocket Limit | $2,000/person; $4,000/family (in & out combined) | $4,600/person; $9,200/family | $10,000/person; $20,000/family | — |

| Routine Office Visits | 100% after $30 Copay | 70% | 90% | 70% |

| Preventive Care | 100% ($0 Copay) | — | 100% ($0 Copay) | — |

| Urgent Care | 100% after $30 Copay | 90% | — | — |

| Telehealth/Virtual Visits | Not Covered | Not Covered | Not Covered | Not Covered |

| Maternity Care | 90% | 70% | 90% | 70% |

| Pregnancy | 100% ($0 Copay) | 100% ($0 Copay) | — | — |

| Inpatient Hospitalization | 90% | 70% up to $1,500/day | 90% | 70% up to $1,500/day |

| Outpatient Hospitalization | — | 70% up to $350/day | — | 70% up to $350/day |

| Diagnostics & Imaging | 70% | 70% | — | 70% |

| Emergency Room Care | 90% after $100 Copay | — | 90% after $100 Copay | — |

| Emergency Medical Transportation | 90% | — | 90% | — |

| Hearing Aid Benefit | 80% (2 aids / 24 months) | — | — | — |

PCP Requirements & How to Get Help

Blue Shield Trio, UHC Harmony, and UHC SignatureValue (SV) HMO plans require you to designate a Primary Care Physician (PCP).

Find Your PCP

- Use each plan’s directory: KeepingLAwell.com/ProviderLookup.

- A mapping letter will show your current PCP and any mapped plan changes.

- Each family member may have a different PCP; dependents must share the same medical plan.

- Download your Benefit Statement and Mapping Letter from the Benefits Central Portal.

Specialist care is accessed through a referral from your PCP. If you’re in ongoing treatment, ask your new plan about continuing care via your medical group’s referral pathways.

Plan Contacts & Support

| Plan | Phone | In-Person Help | Website |

|---|---|---|---|

| Blue Shield | (855) 201-2086 | Open Enrollment Events | KeepingLAwell.com/BlueShield |

| UnitedHealthcare | (800) 980-5216 | Open Enrollment Events | KeepingLAwell.com/UHC |

Designating Your PCP & Medical Group

To keep seeing your current doctor in Blue Shield Trio HMO, UHC Harmony, or UHC SV HMO, designate your Primary Care Physician (PCP) and, if required, your medical group. Refer to your Mapping Letter and Benefit Statement for guidance.

Complete This During Enrollment

You’ll need the following for each doctor you select:

- NPI (National Provider Identifier)

- Doctor’s Name

- Provider/PCP ID of the new plan

Benefits Central Portal

Access your benefits 24/7 from any device—review coverage, make changes, and upload documents.

Sign in options:

- New! Sign in with LA City Google: On the login page, select “Sign in with LA City Google.” Enter your City Google email (

@lacity.org) and password to go straight into the Portal—no Employee ID or temporary password needed. - Employee ID sign in: First-time users can register with your Employee ID (username), birthdate and the last four digits of your SSN (temporary password). Then set a new password and security questions.

Benefits Central Login Screenshot

Need step-by-step instructions for online elections?

Click hereNeed instructions to upload required documents?

Click hereForgot your password?

Click hereVerify In-Network Care

Confirm your doctor or facility is in-network before you enroll. We recommend verifying your PCP and any specialists participate in the plan you choose. Need help? Contact us and we’ll help you look up providers.

Plan Quick Links & Contacts

HMO Plans

Blue Shield Trio HMO

Find Trio network doctors and medical groups.

Open Trio SearchUnitedHealthcare Harmony HMO

Use the Harmony page to open the directory and select a PCP.

Open UHC Harmony PageUnitedHealthcare Signature Value HMO

Use the Signature Value page to open the directory and select a PCP.

Open UHC Signature Value PageUHC How to find a provider on the UHC plan page

- Open the Harmony or Signature Value plan page above.

- Click Open the Directory and choose Continue on the prompts.

- Update your location below the search bar.

- Search by name, specialty, or medical group. Note the Provider ID for enrollment.

Blue Shield How to use the Blue Shield directory

- Open the page for Trio HMO, PPO, or HDHP.

- Enter your ZIP in Location, then search by name/specialty.

- Confirm the plan selector matches your plan and save the Provider ID.

PPO & HDHP PPO Plans

Blue Shield PPO

Find doctors, hospitals, and facilities in the PPO network.

Open PPO Provider SearchBlue Shield HDHP PPO

Find doctors, hospitals, and facilities in the PPO network.

Open HDHP PPO SearchEvents & Webinars

Los Angeles, CA 90012

Los Angeles, CA 90045

Los Angeles, CA 90013

Los Angeles, CA 90012

Los Angeles, CA 90012

Van Nuys, CA 91401

Los Angeles, CA 90015

Los Angeles, CA 90012

Training Room 115B

Los Angeles, CA 90012

San Pedro, CA 90731

Los Angeles, CA 90012

Los Angeles, CA 90071

Open Enrollment 2026: Frequently Asked Questions

General Enrollment Questions

- Minimum Compensated Hours – You must have a minimum number of compensated hours (such as HW, SK, VC, etc.) based on your employment status as follows:

- Full-time employees – at least 40 hours

- Half-time employees – at least 20 hours

- Retirement Contribution – You must continue to be a contributing member to the Los Angeles City Employee's Retirement System (LACERS) or, if authorized by your Memorandum of Understanding, Los Angeles Fire & Police Pensions (LAFPP)

- Eligible Employment Status – You must remain in a job classification and employment type that is authorized to receive LAwell benefits

- A Spouse – Your same sex or opposite sex spouse is eligible if you provide a valid marriage certificate.

- or a Domestic Partner (DP) – Your same sex or opposite sex DP is eligible if your City of Los Angeles Domestic Partnership Affidavit is approved or you provide a copy of your Declaration of Partnership filed with the California Secretary of State

- and/or a Child:

- Your dependent children up to age 26 – including your spouse/domestic partner's children with copies of birth certificates, adoption, or other court papers.

- Your legal custody and/or foster children up to age 26 – if you provide the Employee Benefits Division with copies of court papers.

- Your grandchildren – if the parent is your dependent child up to age 19, or up to age 26 for a full-time student with valid proof of student status.

- Your disabled child of any age – who is dependent on you for support and certified as disabled each year by the insurance company for your health plan.

- Special Situation Child Rule: If your child is also a LAwell eligible City employee, they must enroll into their own LAwell coverage and cannot be covered as your dependent.

- Review your options on the LAwell Enrollment Guide or at KeepingLAwell.com.

- Review your dependent information and eligibility rules. To verify current, add new, or remove ineligible dependents visit Eligibility FAQ's

- Make your Open Enrollment elections!

- Provide Social Security numbers or taxpayer identification numbers for your dependents in the Benefits Central Portal or by calling 833-4LA-WELL (this is for federal tax reporting purposes).

- Document your dependents by the Deadline! Refer to your Enrollment Guidebook for Submission deadlines.

- Review your confirmation statement when you receive it.

- Review the LAwell Enrollment Guide to understand plan rules and successfully manage your benefits over time.

If you take no action during the Open Enrollment period, most of your current 2025 elections will carry over to 2026.

Current Anthem HMO members will be “mapped” into a new Blue Shield or UnitedHealthcare HMO plan based on their Primary Care Physician—see the Medical Plan Change FAQ for details. The exception is your Flexible Spending Account (FSA) and Dependent Care Reimbursement Account (DCRA) elections. These accounts do not carry over each year.

All employees are strongly encouraged to review their benefits options and make an election during Open Enrollment, especially with the upcoming medical plan changes for 2026.

Starting October 1st

To enroll, make changes, and confirm eligibility for your benefits:

- Log in to your Benefits Central Portal account at keepingLAwell.com, available 24/7, OR

- Call the LAwell Benefits Service Center at 833-4LA-WELL (833-452-9355), Monday – Friday, 8:00 a.m. to 5:00 p.m.

- Extended phone hours are provided on Friday, October 31, from 8:00 a.m. to 7:00 p.m.

- (For TDD or TTY service, call 800-735-2922.)

- For all other benefits questions or support, contact your Member Services Representative at per.empbenefits@lacity.org.

- Attend on-site Open Enrollment events.

- Call the LAwell Benefits Service Center at 833-4LA-WELL (833-452-9355), Monday – Friday, 8:00 a.m. to 5:00 p.m.

- Contact a Member Services Representative at per.empbenefits@lacity.org.

- Visit our City Hall office in person. Appointments receive priority and are strongly suggested.

Medical Plan Changes for 2026

The City’s medical plans are changing for plan year 2026 due to the results of a competitive bidding process for the LAwell Program. The City contracts with medical insurance carriers to provide medical insurance to City employees. The LAwell Program’s insurance benefits are a large expense for the City and are subject to this competitive bidding requirement. For fiscal year 2024-25, the City of Los Angeles spent over $400 million in City-paid subsidies toward employee LAwell medical plans (Anthem & Kaiser). The City’s competitive bidding process is widely used and is intended for the City to get the best services at the best price.

The Los Angeles City Charter and Administrative Code outlines the authority and requirements for competitive bidding of any contracted service. This process is commonly referred to as a Request For Proposal (RFP) process. Under the Administrative Code, the LAwell Program is able to execute contracts with bidders selected from a competitive bidding process for up to five (5) consecutive years.

In early 2025, the City held a competitive bidding process to solicit medical insurance proposals from qualified bidders. Blue Shield, Kaiser, and UnitedHealthcare were the winning bidders selected from the City’s competitive bidding process.

Who made the final determination to select the winning bidders?

The results of the RFP were presented at meetings of the Joint Labor-Management Benefits Committee (JL-MBC) and voted on for recommendation to the Personnel Department to administer as authorized by the City Council. The JL-MBC is a committee comprising City Management (specific departments of the City), and Labor Organizations (specific unions that represent City employees). The JL-MBC reviewed the results of the RFP and recommended the selection of Blue Shield, Kaiser, and United Healthcare. Meetings of the JL-MBC are public. Recordings of those meetings are available at: bit.ly/JLMBClivestream. The reports submitted to the JL-MBC are also public and available at www.keepinglawell.com/jlmbc. The specific reports covering the Medical Plans RFP resulting in the selection of Blue Shield, Kaiser, and UnitedHealthcare are:

| 2025 Medical Plans | 2026 Medical Plans |

|---|---|

| Anthem Full HMO (CA Care) | UHC Signature Value (SV) HMO |

| Anthem Narrow HMO (Select) | UHC SV Harmony HMO |

| Anthem Vivity HMO | Blue Shield Trio HMO |

| Anthem PPO | Blue Shield PPO |

| — | Blue Shield HDHP PPO |

| Kaiser | Kaiser |

This table shows the medical plan changes for 2026 compared to 2025.

This answer is best addressed at the plan level:

Anthem PPO Plan

Employees currently enrolled into the Anthem PPO Plan will be automatically assigned to the Blue Shield PPO Plan which offers the same provider network with reduced premiums.

Kaiser Permanente HMO Plan

Kaiser was selected to continue the same plan offered in 2025. Kaiser members will have no change in seeking services or seeing their current doctors as a result.

Anthem HMO Plans (including Anthem Narrow, Anthem Full, and Anthem Vivity)

The City has identified that the vast majority of doctors which employees and their dependents currently see in an Anthem HMO plan are an in-network provider in a Blue Shield HMO and/or UnitedHealthcare HMO plan. The City is taking extensive steps to reduce the disruption caused by this change; to that end, members currently enrolled in Anthem HMO plans will be automatically moved (“mapped”) to the UnitedHealthcare of Blue Shield HMO plan that continues to include current Primary Care Physician(s) (PCP). Additional information will be provided during Open Enrollment. Check now to see if your current doctor and/or hospital is in network using these provider finder tools.

By October, Anthem HMO subscribers will receive a letter from the LAwell Program detailing which plan they will be automatically moved ("mapped") to if they don’t take action.

- Ongoing treatment for a serious condition

- Pregnancy

- Care for a child under age 3

You must contact your new health plan to request Continuity of Care. They will review your application and the details of your treatment plan and, if you qualify, make arrangements for you to continue treatment with your non-network provider. The window for Continuity of Care applications to be submitted is anticipated to open beginning December 2025. More details will be released during Open Enrollment (October).

PPO (Preferred Provider Organization) – You can see any provider, but you'll pay less when you use in-network doctors and facilities. Referrals are not required for specialists. PPOs offer more flexibility but typically have higher monthly premiums.

HDHP (High Deductible Health Plan) – This is a type of PPO with lower monthly premiums but higher deductibles. The full cost of the deductible must be paid before the plan begins paying for most services. It pairs with a Health Savings Account (HSA), which lets you save pre-tax dollars for medical expenses now or in the future. HDHPs can be cost-effective for people who expect low medical use and want to build long-term HSA savings. Click here to learn more.

The High Deductible Health Plan (HDHP) PPO is new for 2026, so its benefit structure is different. It has a higher deductible, high co-pays, and higher out-of-pocket maximum but lower monthly premiums and access to a Health Savings Account (HSA).

Medical Plan Costs per Pay Period — 2025 vs 2026

| Tier | Integrated HMO | Regional HMO | Narrow Network HMO | Full Network HMO | PPO | High Deductible Health Plan (NEW!) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 Kaiser |

2026 Kaiser |

2025 Anthem Vivity |

2026 Blue Shield Trio |

2025 Anthem Select |

2026 UHC Harmony |

2025 Anthem CA Care |

2026 UHC Signature Value |

2025 Anthem PPO |

2026 Blue Shield PPO |

2025 N/A |

2026 Blue Shield HDHP |

|

| Employee Only | $0.00 | $0.00 — | $0.00 | $0.00 — | $0.00 | $0.00 — | $180.03 | $0.00 ▼ | $0.00 | $0.00 — | N/A | $0.00 — |

| Employee + Spouse* | $0.00 | $0.00 — | $0.00 | $0.00 — | $0.00 | $0.00 — | $396.02 | $0.00 ▼ | $539.09 | $445.35 ▼ | N/A | $45.24 — |

| Employee + Child(ren) | $0.00 | $0.00 — | $0.00 | $0.00 — | $0.00 | $0.00 — | $342.01 | $0.00 ▼ | $320.19 | $231.85 ▼ | N/A | $0.00 — |

| Employee + Family | $0.00 | $0.00 — | $0.00 | $0.00 — | $76.17 | $66.73 ▼ | $544.19 | $64.83 ▼ | $828.61 | $730.01 ▼ | N/A | $256.64 — |

| Tier | Integrated HMO | Regional HMO | Narrow Network HMO | Full Network HMO | PPO | High Deductible Health Plan (NEW!) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 Kaiser |

2026 Kaiser |

2025 Anthem Vivity |

2026 Blue Shield Trio |

2025 Anthem Select |

2026 UHC Harmony |

2025 Anthem CA Care |

2026 UHC Signature Value |

2025 Anthem PPO |

2026 Blue Shield PPO |

2025 N/A |

2026 Blue Shield HDHP |

|

| Employee Only | $0.00 | $0.00 — | $0.00 | $0.00 — | $29.26 | $25.63 ▼ | $209.29 | $359.19 ▲ | $317.70 | $280.78 ▼ | N/A | $100.45 — |

| Employee + Spouse* | $489.11 | $517.05 ▲ | $399.23 | $512.61 ▲ | $553.54 | $573.47 ▲ | $949.56 | $675.21 ▼ | $1,190.24 | $1,134.74 ▼ | N/A | $734.63 — |

| Employee + Child(ren) | $407.59 | $430.87 ▲ | $289.20 | $383.97 ▲ | $422.49 | $436.54 ▲ | $764.50 | $596.21 ▼ | $972.34 | $921.24 ▼ | N/A | $576.08 — |

| Employee + Family | $652.15 | $689.39 ▲ | $545.92 | $684.18 ▲ | $728.32 | $756.12 ▲ | $1,196.34 | $754.22 ▼ | $1,480.76 | $1,419.40 ▼ | N/A | $946.03 — |

All LAwell members who are enrolled into benefits in 2025 will continue to be enrolled in the same level of benefits for 2026. If you are in an Anthem HMO medical plan for 2025, you will be “mapped” into a new HMO medical plan with either Blue Shield or UnitedHealthcare based on your current Primary Care Physician designations. You should review your automatic reassignment and take action if you prefer something else.

If you want to contribute to a Flexible Health Spending Account (FHSA) or Dependent Care Reimbursement Account (DCRA) in 2026, you need to make an active election during Open Enrollment. Your current year election will not carry over automatically.

If you're in an Anthem HMO, you and your dependents will be mapped to a UnitedHealthcare or Blue Shield HMO that includes your and your dependents current Primary Care Physicians (PCPs) in its network.

If you're in the Anthem PPO, you'll be assigned to the BlueShield PPO, which has the same provider network and lower premiums.

You can keep your mapped plan or choose any other available plan during Open Enrollment.

High Deductible Health Plan (HDHP)

Dependent Eligibility Verification

Once the Dependent Eligibility Verification audit begins, you may be required to provide documents proving that each dependent covered under your benefits meets the LAwell eligibility rules. Common examples include:

- Marriage certificate for a spouse

- Birth certificate or adoption paperwork for a child

- Domestic partnership registration for a domestic partner

During the 2026 Open Enrollment period (October 1–31, 2025), you should remove any ineligible dependents from your coverage. If you do so at that time, no penalties will apply. The Dependent Eligibility Verification audit is anticipated to take place in the first half of 2026. If the audit identifies that an ineligible dependent still exists in your covered benefits, you will be responsible for repaying all premiums associated with that dependent for the period in which the dependent was ineligible and still enrolled into benefits.

Open Enrollment 2026 tile

Open Enrollment 2026 tile